Many investors want to make quick money by investing and find the futures & options segment as a way to achieve their goal.

While there is nothing wrong with that thought process or approach investors have to follow a process that will help them achieve their goal.

Such a thought process only comes with experience & practice for which a financial advisor is the best choice.

Futures and Options trading is a high risk high reward product and its better to learn the tricks or find a advisor or advisory company who will handhold you and help you to make profits in futures & options trading.

The first and foremost thing to be borne in mind for a new comer is to open an account with a stock broker in both Cash & Futures segment.

A futures contract allows you to buy or sell an underlying stock or index at a preset price for delivery on a future date. Options are of two types – call and put.

A call seller has the obligation to give delivery to the buyer at the preset price even if current market price is higher than former.

An investor needs to understand the margin requirement for the particular stock/ Index in the futures segment.

Apart from that investors have to remember that they have to maintain day to day mark to market i.e there should be sufficient money for fall in stock prices.

For eg an investor buys 1 lot of ACC @ Rs.1000 and the lot size is 100 and on the next trading day the stock price goes down to 950.

Here there is a notional loss of Rs.50 per share and the total notional loss is Rs. 5000/-. This amount of Rs.5000/- should be there in the client account or the client has to transfer the money to makeup the shortfall.

Otherwise the client has to sell his position in a loss. ( The above stock price & lot size are only an illustration and differs from actual prices & lot size).

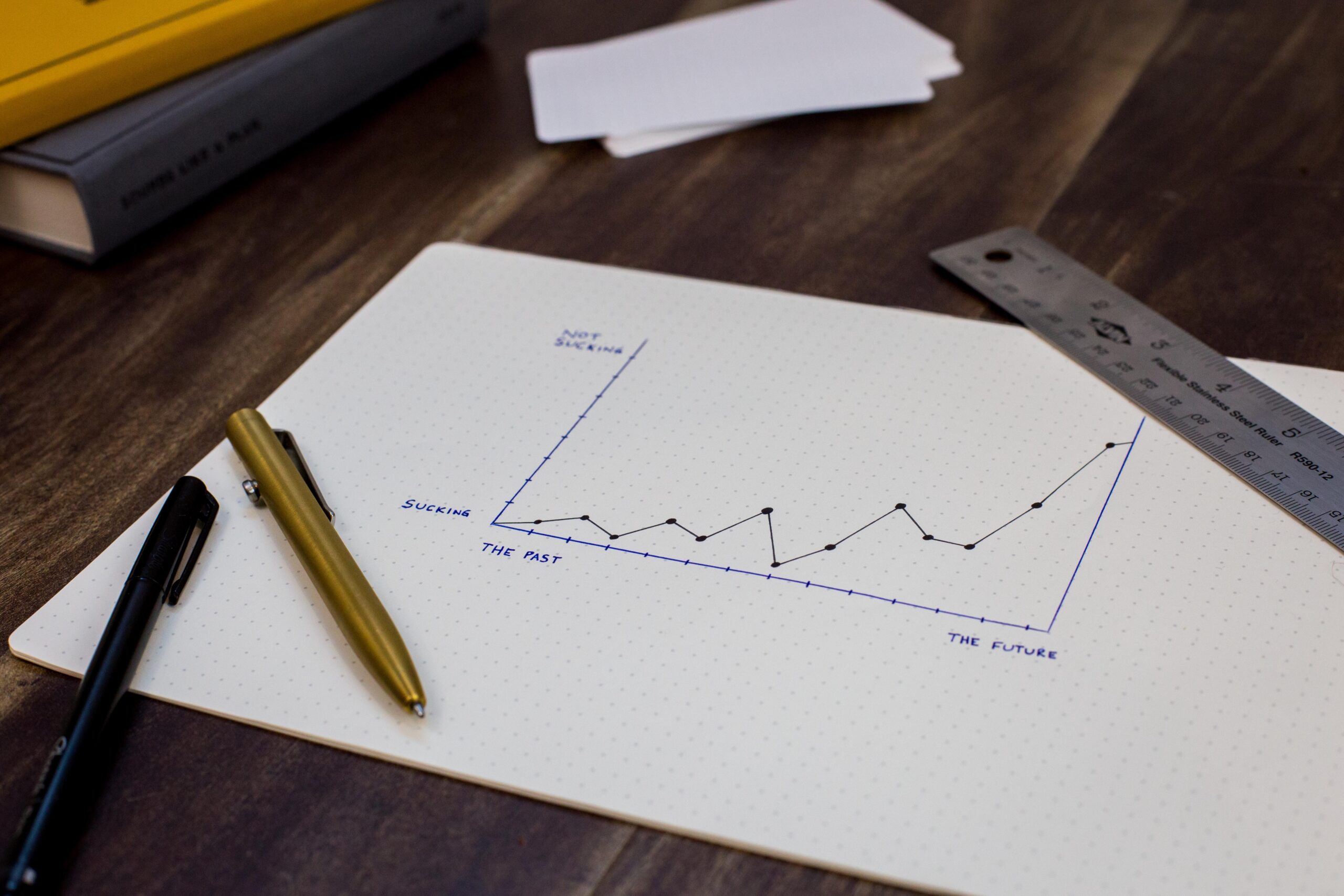

There are 3 ways in which an investor can be a successful trader. The first and foremost trick is to Use F&O more as hedge than as a trade.

The second trick is to get the trade structure right; strike, premium, expiry, risk. Another reason why traders get their F&O trades wrong is due to bad structuring of the trade.

The third and final trick is to focus on trade management; stop loss, profit targets. These are complex trading strategies which can be successfully executed only a professional advisor or advisory company.

On a concluding note Futures and options are very effective tool for protecting your equity investments or earning income from price changes in the underlying stocks & indices.

They provide real opportunities for retail investors to maximize their returns or protect their investments.

Whether you want to trade in futures and options for hedging or speculation, it’s important to have expert guidance in the initial stages which can be provided by a financial advisor. Maintain strict stop loss for all trades done and book profits on stocks hitting target price.

Those who want to make big gains consistently its better to learn technical analysis which will help you with right entry and exit prices.

There are lots of advisory companies who also provide training for technical analysis and its better to learn the tricks and become a successful long term F&O trader.

Happy Investing!